[ad_1]

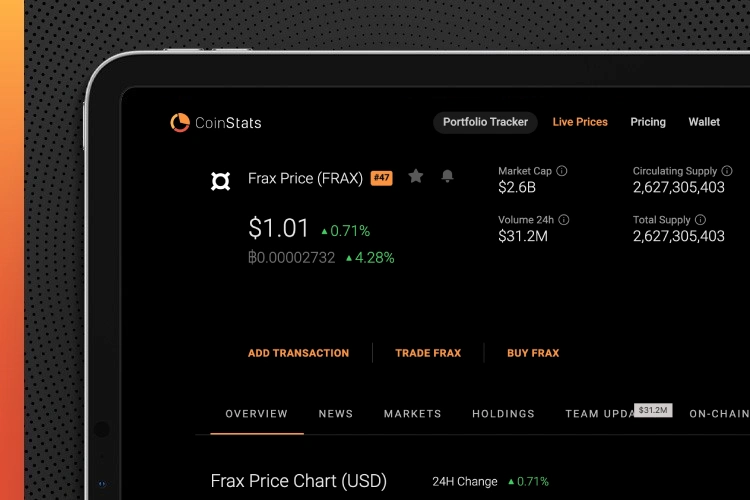

Frax protocol is the primary fractional algorithmic stablecoin system designed to offer scalable and decentralized algorithmic cash rather than fixed-supply digital property.

The Frax system affords quick transactions, ultra-low charges, and the flexibility to commerce instantly with different cryptocurrencies.

Frax Share is the governance token of the Frax protocol.

Learn on for our deep dive into the Frax protocol and the Frax Share token, and learn to purchase Frax cryptocurrency in just a few easy steps.

Let’s bounce proper in!

Creators of Frax

Sam Kazemian, an American software program developer, got here up with the thought of a fractional-algorithmic stablecoin in 2019 and based the Frax Protocol.

The Frax staff contains Travis Moore and Jason Huan, two of the corporate’s main engineers.

Sam Kazemian got here up with the idea when he observed that the variety of stablecoins was quickly rising, however none of them mixed algorithmic financial coverage with collateralization. Algorithmic financial coverage initiatives had both failed or been shut down due to an absence of traction in the true world. So, Frax was created to gauge the market’s confidence in a stablecoin that’s each partially algorithmic and partially collateralized.

What Is Frax

Frax is the primary stablecoin system that makes use of a fractional algorithm and the one stablecoin with components of its provide backed by collateral and components of the availability algorithmic. The ratio of collateralized and algorithmic relies upon available on the market’s pricing of the FRAX stablecoin.

Frax is an open-source, permissionless protocol that runs completely on the blockchain. The Frax protocol’s goal is to create extremely scalable, decentralized, algorithmic cash in lieu of fixed-supply digital property reminiscent of Bitcoin.

Stablecoins had been beforehand categorized into three classes:

- Collateralized with fiat

- Overcollateralized with cryptocurrency

- Algorithmic (didn’t require any collateral).

With Frax, the fourth and distinctive class of stablecoin, with components of its provide backed by collateral and components of the availability algorithmic, is formally launched.

The availability of Frax stablecoin is continually altering as a result of its fractional-algorithmic financial coverage. Which means the worth of the stablecoin all the time stays at $1. FXS tokens have had a tough cap of 100 million at first of the protocol, and there’s no manner so as to add extra tokens sooner or later.

The Frax protocol is a two-token system encompassing a stablecoin, Frax (FRAX), and a governance token, Frax Shares (FXS). FXS is a monetary funding and governance asset, whereas Frax is a cryptocurrency-tokenized forex.

The method of minting and redeeming FRAX tokens helps preserve the worth stability of the stablecoin. Accordingly, the extra folks use the protocol, the extra steady the FRAX token turns into. Moreover, the demand for FRAX tokens influences the worth of the FRAX token and may create arbitrage alternatives.

FXS token holders can vote on proposals, together with the addition of recent collateral swimming pools, proposals to make modifications to payment buildings, and “the speed of the collateral ratio.”

The veFXS token mannequin is a “vesting and yield system,” and by locking up FXS tokens, holders obtain veFSX in return. The variety of veFXS tokens {that a} staker receives is proportional to the length of their stake. The veFXS token is non-transferable and can’t be traded on liquid markets, as a substitute, it goals to encourage long-term staking.

The venture’s imaginative and prescient is to develop into the primary crypto native client value index (CPI), which FXS token holders will govern. At present, the FRAX token is price-pegged to the US greenback. Nonetheless, the venture goals to help a number of currencies and develop into a worldwide permissionless unit of account sooner or later.

The place to Purchase Frax

You may solely purchase Frax on decentralized exchanges with one other cryptocurrency. To purchase Frax Share, you’ll want first to buy Ethereum (ETH), after which use ETH to purchase Frax. For this, you’ll want a self-custody crypto pockets. The highest six self-custody wallets in the present day are:

- Coinbase pockets – the most effective pockets for inexperienced persons.

- Belief pockets – with the most effective backup system.

- Electrum –the most effective one for Bitcoin.

- Mycelium – your best option for cell functions.

- Ledger Nano X – the most effective offline cryptocurrency pockets at present obtainable.

- Exodus – the most effective one on the desktop.

In the intervening time, the most well-liked cryptocurrency exchanges for buying and selling Frax are Binance, CoinW, HitBTC, Pionex, Gate.io, Curve Finance, Uniswap (V2), Uniswap (V3), Pancakeswap, and Hotbit.

Moreover, the Frax Shares, or the FXS tokens, can be found on numerous exchanges and are as liquid because the Frax stablecoins. Buyers occupied with buying governance rights to the world’s first stablecoin protocol ought to contemplate buying Frax Shares (FXS).

The acquisition of the Frax token is beneficial for these occupied with value stability via using a fractional-algorithmic stablecoin.

Purchase Frax

Your first step is to discover a cryptocurrency platform providing among the lowest transaction charges within the business to commerce, purchase, and promote Frax. You must also evaluate the safety, popularity, deposit strategies, supported fiat currencies of the platforms to decide on the one which most accurately fits your wants.

Frax Can Be Bought Utilizing Cryptocurrency

If you have already got completely different digital tokens in an exterior pockets, you should use them to buy Frax. All it’s important to do is deposit the cash into your Belief Pockets or Coinbase pockets, for instance, and change them for Frax utilizing a DEX (decentralized change) reminiscent of Uniswap or Pancakeswap. After that, you’ll be able to withdraw Frax to an exterior ERC-20 pockets.

- Obtain and arrange the self-custody pockets you favor (Coinbase, Belief, Ledger Nano, and so on.).

- Take into account Ethereum community charges, which range in response to how busy the community is and relying on the complexity and the pace of the transaction.

- Purchase and switch ETH to your self-custody pockets.

- Use your ETH to purchase Frax.

Frax Can Be Bought Utilizing a Debit or Credit score Card

In the event you want to buy Frax utilizing your debit or bank card, you are able to do so via both a centralized or decentralized change. A centralized change makes it attainable to buy Frax instantly by first buying one other digital token after which exchanging it for Frax. It’s attainable to buy cryptocurrencies along with your debit or bank card via a self-custody pockets.

It’s price noting that you could undergo a “Know Your Buyer” (KYC) verification course of to commerce with fiat forex.

Is It Attainable to Buy FXS Utilizing Money

There isn’t any direct approach to buy FXS with money at the moment. Nonetheless, you should use marketplaces reminiscent of LocalBitcoins to first buy bitcoin (BTC) after which full the remainder of the method by transferring your bitcoin to the suitable AltCoin change.

LocalBitcoins is a Bitcoin change that operates on a peer-to-peer foundation. A Bitcoin change is a market the place customers can buy and promote bitcoins instantly. Customers known as merchants submit adverts on the web with the worth and cost methodology they want to supply. You may select to purchase from retailers in a selected neighboring area based mostly in your preferences on the platform. The draw back is that prices on this web site are usually greater, and you could proceed cautiously to keep away from being defrauded.

Execs and Cons of Shopping for Frax

To purchase or to not purchase? That’s the query. There are a lot of advantages to investing in Frax, however there are additionally some downsides that it is advisable contemplate earlier than making your resolution. Before you purchase Frax and add it to your cryptocurrency portfolio, it is best to contemplate the next elements:

- Frax is a stablecoin soft-pegged to the US greenback, so the token’s provide is risky and retains altering in response to the fractional algorithmic technique to hold an asset’s value at $1.

- The governance token for the Frax ecosystem is FXS (Frax Shares). Extra collateral worth, accrued charges, and seigniorage income are all generated via this mechanism.

- The ratio of collateralized and algorithmic relies upon available on the market’s pricing of the FRAX stablecoin. There’s much less collateral at greater costs, whereas at decrease costs, there’s extra collateral required.

- Frax depends on reserves and is under-collateralized. In accordance with the governance protocol, it’s absolutely backed by property. If USDC or USDT accounts for 40% of the entire, FSX should account for the remaining 60%.

- As well as, the stablecoin is supported by FXS.

- USD Coin (USDC) and USD Tether are two potential stablecoins that would offer among the essential help for this coin.

- Community information is accessed via using oracles on this protocol. Chainlink and Uniswap are used to calculate the time-weighted common costs for ETH, USDT, and USDC.

To keep away from shedding cash when buying Frax, it is best to analysis the dangers related to it. Like different digital property, the numerous threat is the volatility of its worth within the cryptocurrency market. In the event you money out when the worth falls beneath the quantity you acquire, you’ll lose cash.

For this reason it is best to spend money on Frax with warning:

- Keep a decent degree of stakes.

- Buy Frax in small but frequent dosages. That is known as the dollar-cost averaging method.

- Put money into extra Defi cash to diversify your digital token holdings.

Conclusion

Within the cryptocurrency market, Frax is an modern cryptocurrency that has taken the business by storm. Quick transfers, low prices, and the flexibility to commerce instantly with different cryptocurrencies are all options of the Frax system.

The Frax staff might be deploying their protocol to Moonbeam in order that their stablecoin will be minted natively on Polkadot. This integration will enable customers and groups within the Polkadot and Moonbeam ecosystems to entry extremely scalable, steady, and on-chain cash.

We now have defined purchase Frax and why it is perhaps a great funding on this submit. Do not forget that it’s solely attainable to commerce Frax on decentralized exchanges as a result of it’s a cryptocurrency tokenized forex.

The Frax token, often known as the FXS token, is traded on quite a few exchanges and is offered in a liquid state.

The token provide of Frax, a stablecoin that’s softly tied to the US greenback, fluctuates. Within the bitcoin market, Frax’s worth goes up and down, which is among the greatest downsides.

Get hold of your individual recommendation, and contemplate your individual circumstances earlier than counting on the data on this article.

Confirm the character of any service or product (together with its related regulatory necessities and authorized standing) and evaluation the related regulators’ web sites earlier than making any funding selections.

You can too test our weblog for extra informative articles about wallets, crypto exchanges, and tokens, together with purchase Gala and a number of other different cryptocurrencies.

[ad_2]

Source link